how to avoid estate tax in california

Here are some ways to avoid probate in California Estate. A full chart of federal estate tax rates is below.

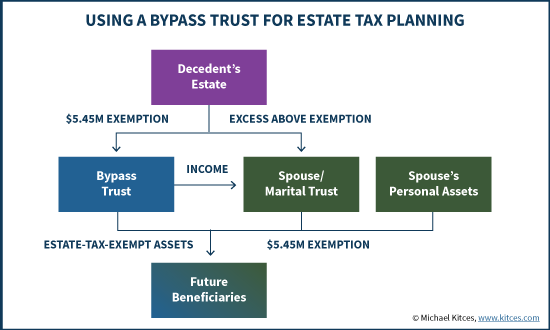

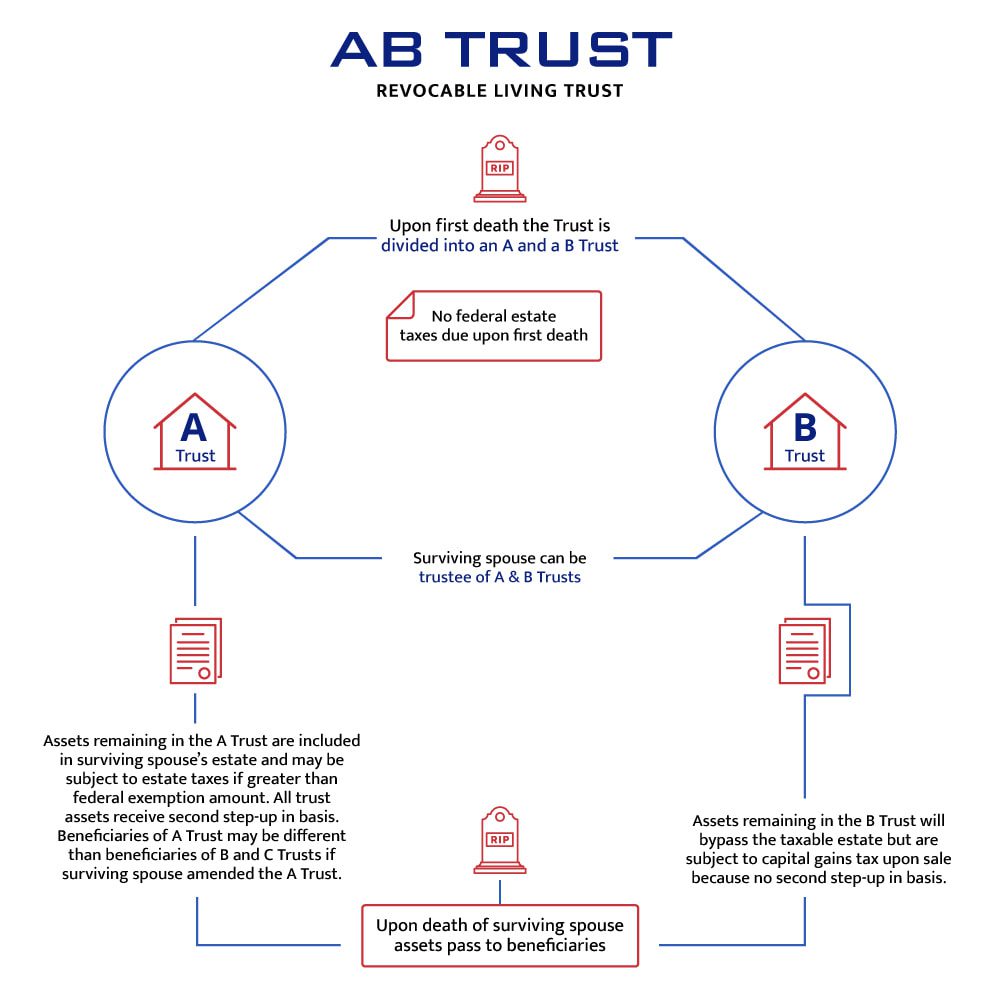

Distributable Net Income Tax Rules For Bypass Trusts

So if you want to avoid paying taxes then you usually have to figure out a way to reduce your taxable income.

. To do so an. 18 to 40 on estates over 117 million. The surest way to avoid or reduce estate taxes in California and other states is to give off portions of your estate as gifts to your beneficiary.

This goes up to 1206 million in 2022. You can subtract the excess of any gifts over the 15000 per person per year annual exclusion from your 1206 million estate tax exemption but this will leave less of the exemption to cover your estate from estate taxation when you die. Inheritance tax in California.

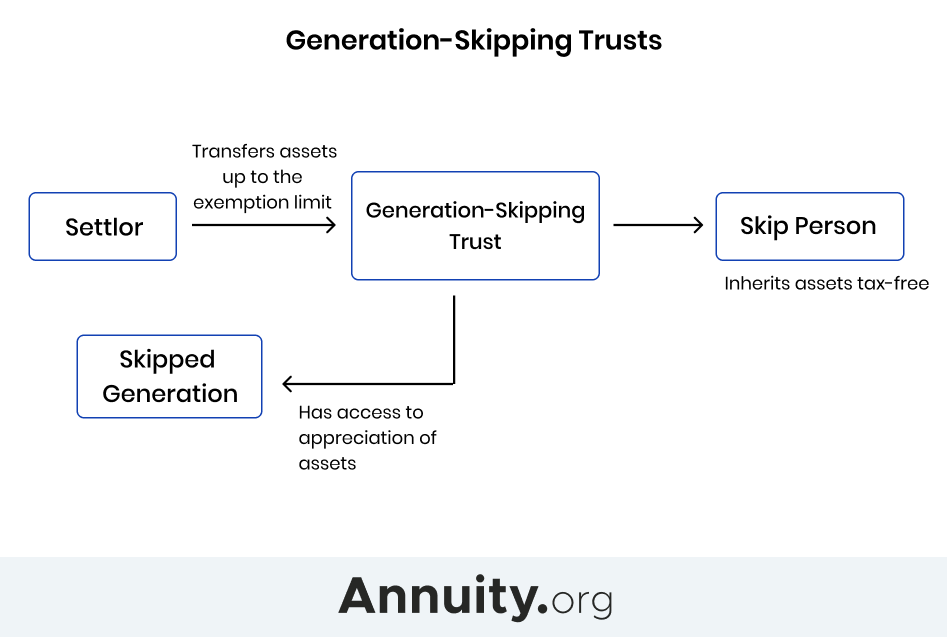

With the exception of the estate tax for estates exceeding 1158 million dollars per person California does not have a state-level inheritance tax. However there are times when it is necessary to change the ownership structure to either protect the. Unlimited marital deduction trusts GST tax gift tax charitable contributions.

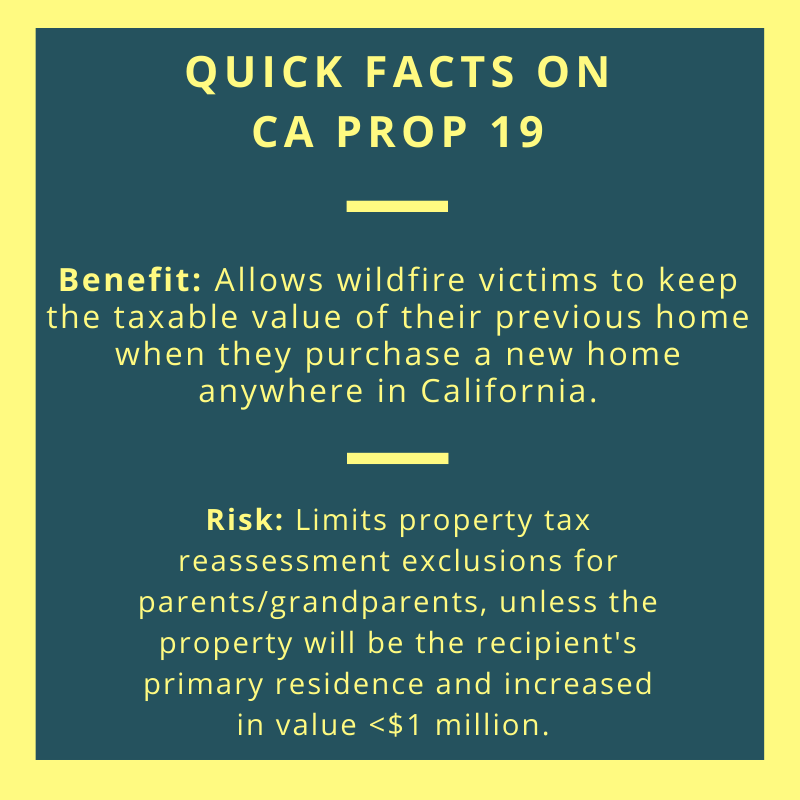

Ad From Fisher Investments 40 years managing money and helping thousands of families. You children might be subject to higher property taxes if they keep the home. Probate laws will vary from state to state.

Although there is no California inheritance tax there could be certain situations where an individual would rather reject an inheritance. How do I avoid capital gains tax on real estate in California. See whether you qualify for an exception.

The income tax basis of the home will be stepped up to the current market value at each of your deaths. With rising real estate prices it is increasingly becoming important to make sure your property taxes are not reassessed based on a higher property value. There are 3 requirements imposed.

Regardless of the size of the estate the Franchise Tax Board think the IRS for the state of California will not levy any estate taxes on the inheritance. 24 Disclaim the inheritance altogether. 21 Sell the property as fast as you can.

And you want to do this in a way where of course you dont go broke but you delay your income for later. Estate planning strategies in California. Federal estate tax in California.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Do this while you are still alive every year for as long as it takes to bring your overall estate below the 117 million mark. Dar Mardan Vida Dashloo are real estate agents that serve Los Angeles Orange County and San DiegoWe are located in Newport Beach CaliforniaThese educa.

If you want to reject or disclaim an inheritance it can be done but it takes a little more than simply telling the executor you do not want the property. The California Estate Tax. This will allow you to avoid probate for virtually anything of value you own.

There are ways individuals can protect their assets by avoiding probate so that they can pass the maximum amount possible down to their heirs. The two years dont need to be consecutive but house-flippers should beware. That is not true in.

1 Sale occurs 2 years after purchase 2 House must be used as the main home for 2 out of the 5 years prior to sale and 3 Not excluded under 250k500k capital gains exemption. For those interested in Estate Planning here in California you should likely set up a living trust. Wait until they inherit the property.

For estates that exceed this amount the top tax rate is 40. The estate tax is paid out of the estate so the beneficiaries will not be liable for paying the estate tax technically speakingalthough it would deplete the amount left in the estate for distribution. Set Up A Living Trust to Avoid Probate In California.

Ad Learn How To File Taxes From A Live Tax Expert With TurboTax Live. Estate planning with a financial advisor can help you avoid or reduce. 23 Defer your taxes as an investment property.

If you make no changes your children will inherit the home after you both pass away. Avoiding Probate in California Estate. These are just the more common examples of non-value ways to reduce taxes related to commercial real estate in California.

No Matter The Complexity Of Your Tax Situation TurboTax Helps You File With Confidence. 22 Make the property your primary residence. This tax has full portability for married couples meaning if the right legal steps are taken a married couple can avoid paying an estate tax on up to 2406 million after both have died.

2 How to Avoid Inheritance Tax and Capital Gains Tax in California. Keep the receipts for your home improvements. Since each requires timely action on the part of taxpayers many of these opportunities are lost simply because an owner is unaware that the procedure exists or despite knowing about it fails to appreciate the consequences.

Individuals looking to avoid probate can create a living trust under California law on any asset they own. Live in the house for at least two years. The tax system can be simplified like this the more income you make the more taxes you pay.

There are several ways you can avoid capital gains tax for houses in California. In California all counties are allowed to reassess property taxes when there is a change in ownership. The following are your options to avoid probate here in California.

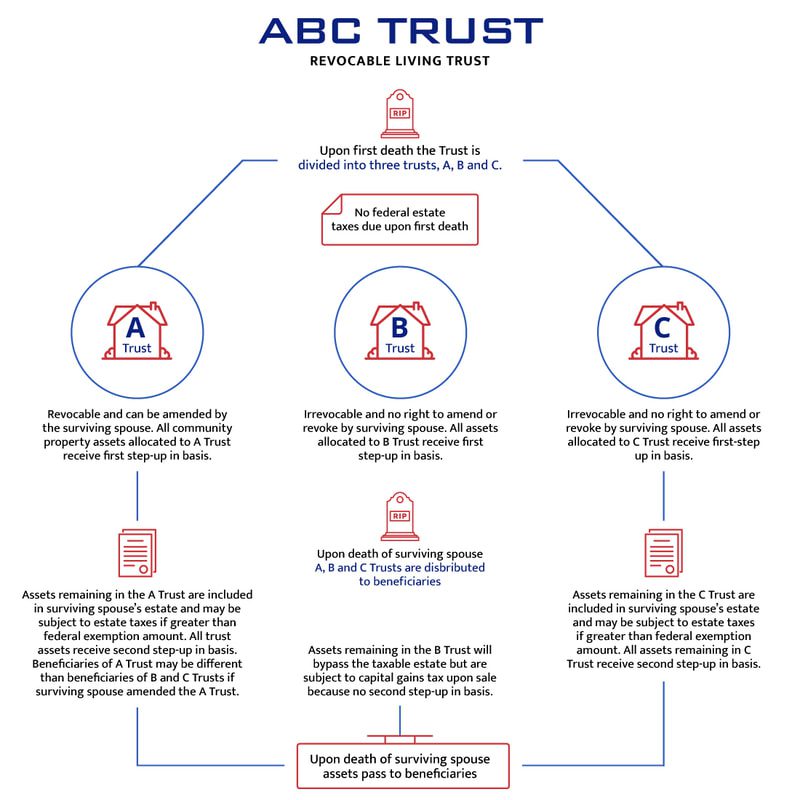

To A B Or Not To A B That Is The Question Botti Morison

The Property Tax Inheritance Exclusion

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

Taxes On Your Inheritance In California Albertson Davidson Llp

How To Avoid Estate Tax For Ultra High Net Worth Family

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

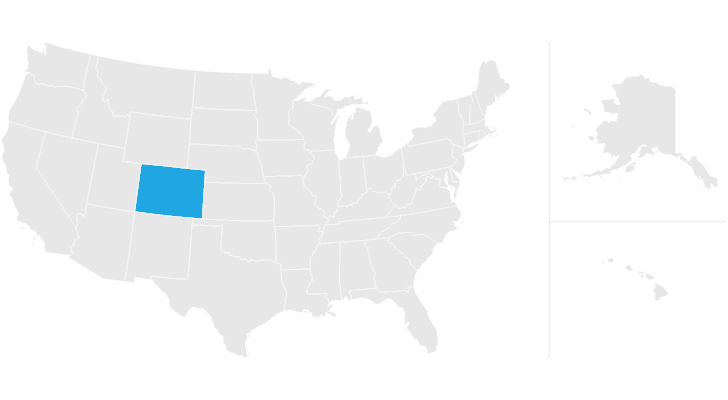

Colorado Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

California Gift Tax All You Need To Know Smartasset

How To Avoid Estate Tax For Ultra High Net Worth Family

5 Ways The Rich Can Avoid The Estate Tax Smartasset

To A B Or Not To A B That Is The Question Botti Morison

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Avoid Estate Tax For Ultra High Net Worth Family

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Prop 19 Could Affect Your Estate Plan Law Offices Of Daniel A Hunt

Generation Skipping Trust Gst What It Is And How It Works

States With No Estate Tax Or Inheritance Tax Plan Where You Die